"Decentralized Finance (DeFi): Revolutionizing Traditional Banking Services"

Introduction The emergence of blockchain technology has paved the way for a transformative concept known as decentralized finance (DeFi). DeFi aims to revolutionize traditional banking services by leveraging the decentralized nature of blockchain to create an open, transparent, and inclusive financial ecosystem. In this article, we will explore the concept of DeFi, its key components, its impact on traditional banking services, and the potential benefits and challenges associated with its adoption.

Section 1: Understanding Decentralized Finance (DeFi) 1.1 Defining Decentralized Finance (DeFi)

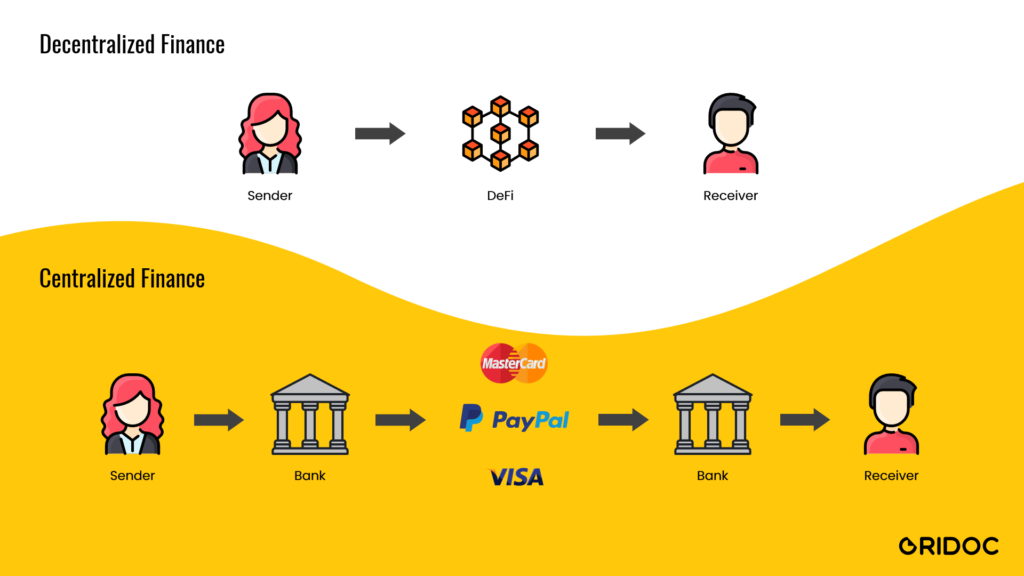

- Define DeFi and explain its fundamental principles, including the elimination of intermediaries, transparency, and open access.

- Highlight the key characteristics that distinguish DeFi from traditional banking services.

1.2 Smart Contracts and Decentralized Applications (DApps)

- Discuss the role of smart contracts in enabling the automation and execution of financial transactions in the DeFi ecosystem.

- Explain how decentralized applications (DApps) leverage smart contracts to provide various financial services.

1.3 Decentralized Exchanges (DEXs)

- Explore the concept of decentralized exchanges and their role in facilitating peer-to-peer trading of cryptocurrencies without relying on traditional intermediaries.

- Discuss the advantages of DEXs, such as increased security, lower fees, and improved liquidity.

Section 2: Disrupting Traditional Banking Services 2.1 Payments and Remittances

- Discuss how DeFi enables faster, more affordable cross-border payments and remittances compared to traditional banking systems.

- Highlight the potential for financial inclusion, particularly for the unbanked and underbanked populations.

2.2 Lending and Borrowing

- Explain how DeFi platforms enable peer-to-peer lending and borrowing without the need for traditional financial institutions.

- Discuss the benefits of decentralized lending, such as lower interest rates, increased accessibility, and reduced bureaucracy.

2.3 Stablecoins and Decentralized Stablecoin Issuance

- Introduce the concept of stablecoins, which are cryptocurrencies designed to maintain a stable value relative to a particular asset or currency.

- Discuss how decentralized stablecoin issuance platforms provide stability and enable efficient cross-border transactions.

Section 3: Benefits and Opportunities of DeFi 3.1 Financial Inclusion and Accessibility

- Highlight how DeFi can empower individuals who are underserved by traditional banking systems, particularly in developing countries.

- Discuss the potential for greater financial access and economic opportunities through decentralized financial services.

3.2 Transparency and Trust

- Explain how the transparency and immutability of blockchain technology in DeFi enhance trust and reduce the risk of fraud and manipulation.

- Discuss the potential for increased accountability and auditability of financial transactions.

3.3 Programmability and Innovation

- Explore the programmability of DeFi protocols and the ability to create complex financial instruments and automated processes.

- Discuss the potential for innovation and new financial products and services within the DeFi ecosystem.

Section 4: Challenges and Risks 4.1 Security and Smart Contract Vulnerabilities

- Highlight the importance of robust security measures in DeFi platforms and the potential risks associated with smart contract vulnerabilities.

- Discuss the need for rigorous code audits and security best practices to mitigate these risks.

4.2 Regulatory Compliance and Legal Challenges

- Discuss the regulatory challenges surrounding DeFi, as decentralized nature poses challenges for traditional regulatory frameworks.

- Explore the need for regulatory clarity and the potential impact of regulatory actions on the DeFi ecosystem.